Accounting and Audit services

We can assist you in maintaining current and accurate records of your business's financial activities with our accounting services. Whatever your company's size, accounting is essential to financial success assessment, cost-planning, and decision-making. Our accounting services are overseen by a team of highly experienced certified accountants that follow the International Financial Reporting Standards (IFRS).

Advantages of Outsourcing to Accounting Services in Dubai, UAE

- Helps Streamline Your Financial Operations and focus on core business activities.

- Instead of hiring and training in-house accountants, you can leverage our services at a fraction of the cost.

- Stay Compliant with Local Regulations as we can help you with handling all the necessary reporting, filing, and documentation, saving you time and reducing the risk of penalties or legal issues.

- Helps gain access to a team of highly skilled and experienced accounting professionals. Our experts stay updated with the latest regulations and best practices, ensuring that your financial matters are handled with precision and compliance.

Our Accounting Services

- Bookkeeping: The hassle of keeping track of, updating, and reconciling your bank accounts daily will be eased by our accountants.

- Financial Reporting: We offer financial reports to assist you in assessing the performance of your company.

- Payroll Management: We will manage your company's monthly payroll, including generating reports, gratuity calculations.

- Internal Audit: We will help In Assessing and Examining the business risks, operation processes of the company and evaluating its overall performance.

- External Audit Services: We will assist you in completing the auditing process for your financial year and ensure your records are maintained per International Financial Reporting Standards (IFRS).

Taxation

Corporate Tax

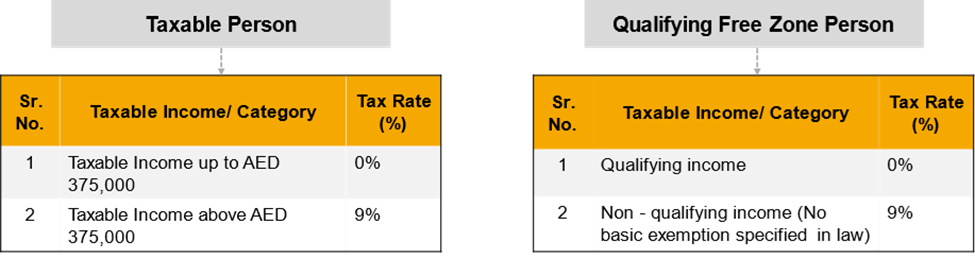

In a significant move towards international tax transparency standards, the United Arab Emirates (UAE) Ministry of Finance (MoF) has introduced Federal corporate tax legislation in the UAE. Effective from financial years beginning on or after June 1, 2023, the UAE Corporate Tax (CT) law imposes a headline rate of 9%, positioning the UAE as one of the most competitive tax jurisdictions globally. While awaiting further clarifications, the MoF has issued 158 Frequently Asked Questions to supplement the law, providing insights into its scope, applicability, and various provisions. Understanding corporate tax laws is paramount for business owners operating in the UAE.

Key Features of the Corporate Tax Law in the UAE:

- Taxable Persons:

- Residents in the UAE: This includes juridical persons incorporated in the UAE, natural persons conducting business in the UAE, foreign juridical persons managed and controlled in the UAE (POEM), and any other specified persons.

- Non-Residents: Entities with a permanent establishment in the UAE, earning UAE-sourced income, or having nexus in the UAE are subject to corporate tax.

- Exempt Persons and Incentives:

- Certain entities are exempt from corporate tax, subject to meeting specific conditions. These include government entities, government-controlled entities, qualifying investment funds, pension, or social security funds, among others.

- Small businesses below a revenue threshold may claim "small business relief" and be treated as having no taxable income for the relevant period. The revenue threshold for this relief is yet to be specified.

- Applicability to Free Zones:

- To qualify for a 0% corporate tax rate, qualifying free zone entities must fulfill conditions such as maintaining adequate substance in the UAE, deriving qualifying income, complying with transfer pricing regulations, and meeting other prescribed conditions by the MoF.

Conclusion:

Businesses need to assess the impact of the new corporate tax law on their operations, ensuring readiness to manage compliance and reporting obligations. Maintaining adequate documentation from a corporate tax perspective is essential for smooth compliance. In conclusion, the introduction of corporate tax in the UAE marks a significant shift in its tax landscape, emphasizing the importance of understanding and adhering to these regulations for businesses operating within the country.

Transfer Pricing

The experienced professionals of Archer’s are ready to meet your domestic and global transfer pricing needs.

Multinational enterprises (MNEs) with expansion into the United Arab Emirates market, as well as the rest of the middle east market, need to proactively consider how to structure their related party transactions in a manner that is consistent with the arm’s length principle and makes business sense. Our highly experienced transfer pricing team is there to assist you in designing, documenting, and implementing a transfer pricing policy that achieves the above objectives.

In addition, considering the aggressive nature of transfer pricing implementation in the United Arab Emirates, it is imperative that MNEs with footprints in the Middle East should have seasoned transfer pricing advisors with international and local experience to support them with the preparation of robust transfer pricing documentation that will improve their chances of successful defense during transfer pricing reviews.

In summary, our team can help your company with all aspects of transfer pricing, including:

- Assist in setting up transfer pricing policy for the Group

- Advice on an implementation plan (TP Planning)

- Set transfer pricing methods and guidance

- Prepare transfer pricing documentation (local file, master file, CbCR)

- Help companies request Advanced Pricing Agreement (APA) and/or initiate Mutual Agreement Procedures (Competent Authority)

- Assist with transfer pricing audit / assessments and tax controversy

VAT accounting services have assisted organizations report their finances accurately since the UAE implemented VAT on January 1, 2018.

It involves maintaining detailed records of VAT transactions, including sales, purchases, debit note, credit note, and VAT paid and collected. This information is essential for preparing financial statements and ensuring compliance with accounting standards. The VAT is a consumption-based tax that is imposed on the value added at each stage of the supply chain. The standard VAT rate in the UAE is 5%, with certain goods and services being exempted, zero-rated, or covered under reverse charge mechanism.

We provide our customers the best advice on all the aspects of VAT, whether you are the head of a business or an individual trader. We ensure compliance, streamline the process, and assist in lowering the cost of VAT and other taxes. With years of experience in this field, our VAT experts provide tailored guidance that meets your company's needs.

How Archer's Can Help You for VAT Registration?

Our team of highly qualified and experienced chartered accountants will make it effortless for you to comprehend and abide by the UAE's value-added tax laws. Our team will evaluate your purchase orders, contracts, quotes, and invoices to see if your company qualifies for the registration under mandatory or voluntary basis.

- VAT Registration: Our tax specialists will advise you on whether you qualify for a VAT registration or exception and will also help you register your company with the FTA for VAT to avail a certificate bearing your Tax Registration Number (TRN) after completing the registration process.

- VAT Return Report:

- Record keeping - Maintain records of all taxable transactions to ensure compliance with VAT regulations.

- Preparing of VAT return - Calculate VAT liabilities or refunds and prepare the VAT return forms.

- Submission of VAT return

- Ongoing compliance and advisory

Excise tax is a form of indirect tax levied on specific goods that are harmful to human health or the environment. Such goods can include carbonated drinks, energy drinks, tobacco products and the like.

Our professional Excise Tax services include:

Excise Tax Advisory

- Specific comments on Excise Transactions

- Guidance on Excise Tax Declarations for transactions

- Advice on practical aspects & application of Excise Tax law.

- Assistance in preparation of the Excise Tax Registration & De-registration

- Liaising with the FTA for iterations & finalization.

- Analyze the impact of Excise Tax on the business

- Define the transactions subjected to Excise, drafting of policies & procedures

- Detailed training to develop the compliance model.

- A 360 degree review of Excise Tax compliances followed by a detailed report highlighting the exposure, corrective measures and areas of improvement.

- Detailed review of accuracy, completeness, valuation & cut-off dates.

- Assess sales, purchases & production losses. • Support in the preparation, review & submission of periodic tax return.

- Facilitate liaison with the FTA during tax audit

- Support in drafting submissions/responses before the FTA

- Guidance on rectification of errors.

- Review of audit memos, decisions and meeting minutes.

- Draft/review and submission of important applications before the FTA, such as Voluntary Disclosure applications (VD), Penalty Waiver/Installment applications, application before Tax Dispute Resolution Committee

- Guidance and support to experts appointed by court

- Classifying products for customs tariff purposes

- Assistance with customs planning to lower transaction costs

- Customs-related advisory services - audits and reconciliations

- Identify Customs Compliance Organization opportunities

- Assistance with obtaining customs licenses

- Set-up and implementation of customs processes

- Customs valuations